how much taxes deducted from paycheck nc suburban

Use ADPs North Carolina Paycheck Calculator to estimate net or take home pay for either hourly or salaried employees. This North Carolina hourly paycheck.

Free North Carolina Payroll Calculator 2022 Nc Tax Rates Onpay

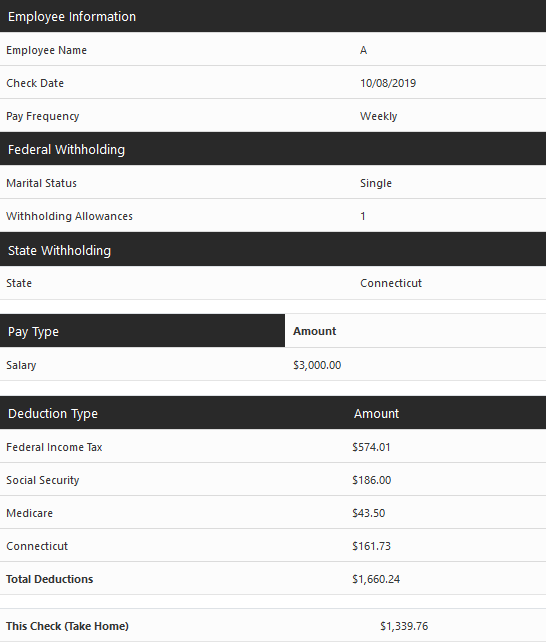

For Tax Years 2015 and 2016 the North Carolina individual income tax rate is 575 00575.

. 95-258 Withholding of Wages an employer may withhold or divert any portion of an employees wages when. Any wages above 147000 are exempt from. In North Carolina The state income tax in North Carolina is 525.

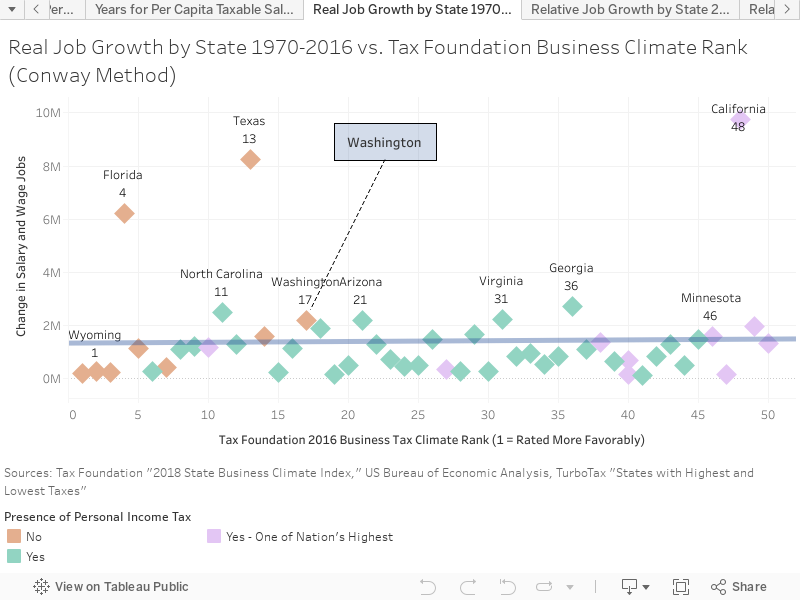

Logan Harris Author At The Pulse In What Ways Do Cities Subsidize Suburbs R. This free easy to use payroll calculator will calculate your take home pay. The median household income is 52752 2017.

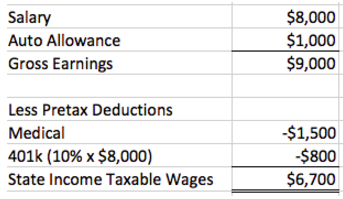

Effective January 1 2020 a payer must deduct and withhold North Carolina income tax from the non-wage compensation paid to a payee. If your filing status is. Your standard deduction is.

Take home pay is calculated based on up to six different hourly pay rates that you enter along with the pertinent federal state and local W4 information. North Carolinas flat tax rate for 2018 is 549 percent and standard deductions were 8750 if you filed as single and 17500 if you were married and filing jointly. It is a flat rate that is unchanged.

This is tax withholding. The income tax is a flat rate of 499. Hourly non-exempt employees must be paid time and a.

Subtract and match 62 of each employees taxable wages until they have earned 147000 2022 tax year for that calendar year. Just enter the wages tax withholdings and other information required. The payer has to deduct an amount of tax based on the rules prescribed by the.

North Carolinas flat tax rate for 2018 is 549 percent and standard deductions were 8750 if you filed as single and 17500 if you were married and filing jointly. Use the chart below to determine the amount of your NC. What percentage of tax is taken out of my paycheck in Colorado.

95-258 a 1 - The employer is required to. The amount of taxes to be. Advance Child Tax Credit.

In October 2020 the IRS released the tax brackets for 2021. Minimum Wage in North Carolina in 2021. No state-level payroll tax.

Supports hourly salary income and multiple pay frequencies. Standard deduction based on your filing status. Therefore it will deduct only the state income tax from your paycheck.

Use this tool to estimate the federal income tax you want your employer to withhold from your paycheck. How much taxes deducted from paycheck nc suburban Thursday March 3 2022 Edit. How Is Tax Deducted From Salary.

15 Minimum Wage Won T Cover Living Costs For Many Americans

Free Online Paycheck Calculator Calculate Take Home Pay 2022

Who Really Pays Economic Opportunity Institute Economic Opportunity Institute

North Carolina Hourly Paycheck Calculator Gusto

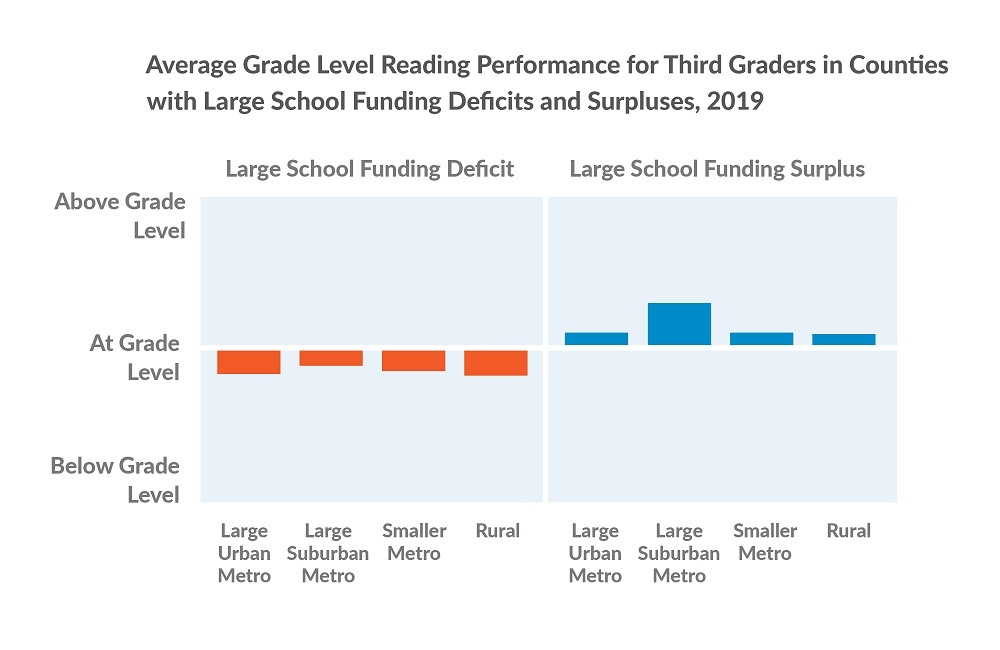

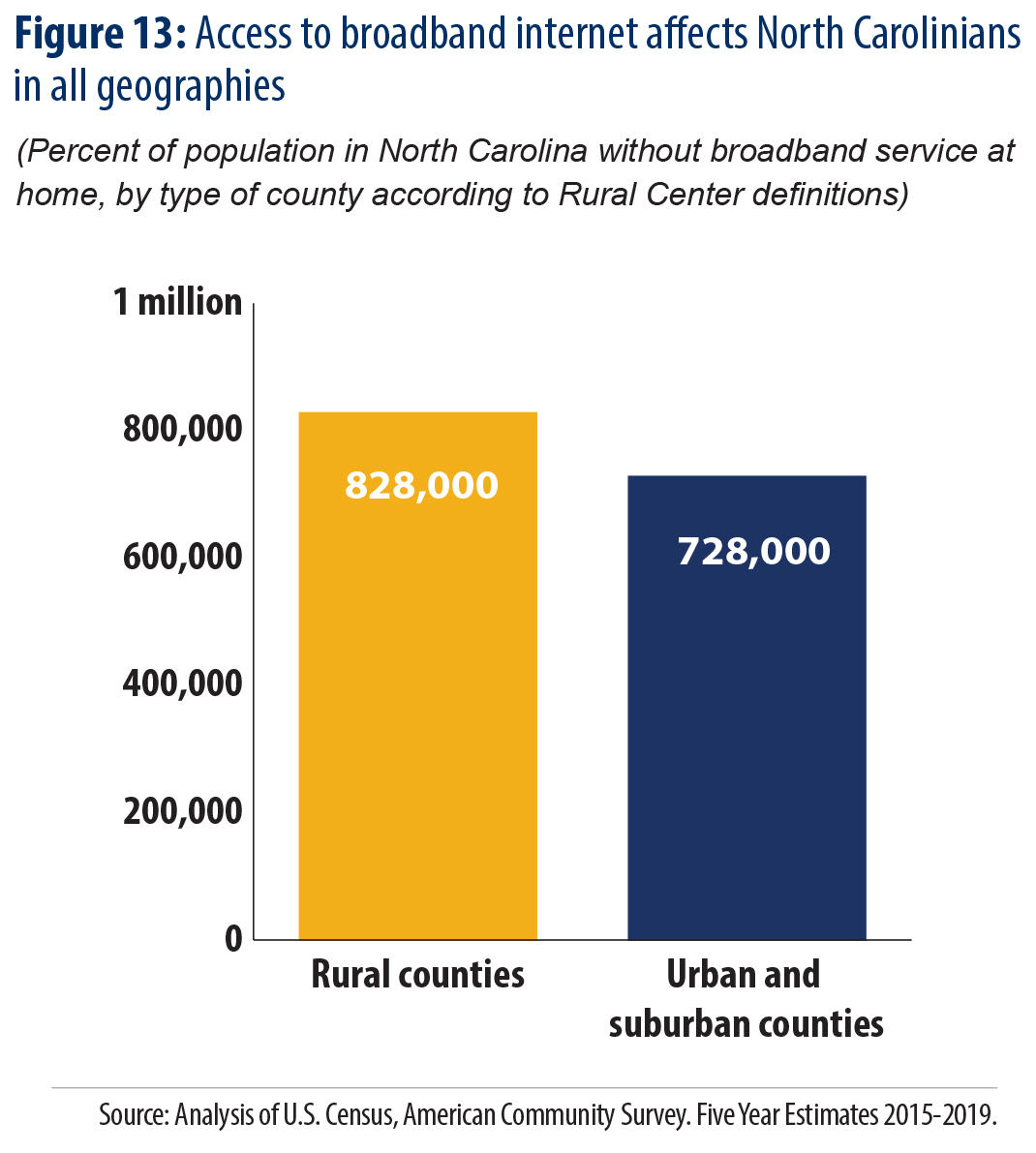

2022 County Health Rankings National Findings Report County Health Rankings Roadmaps

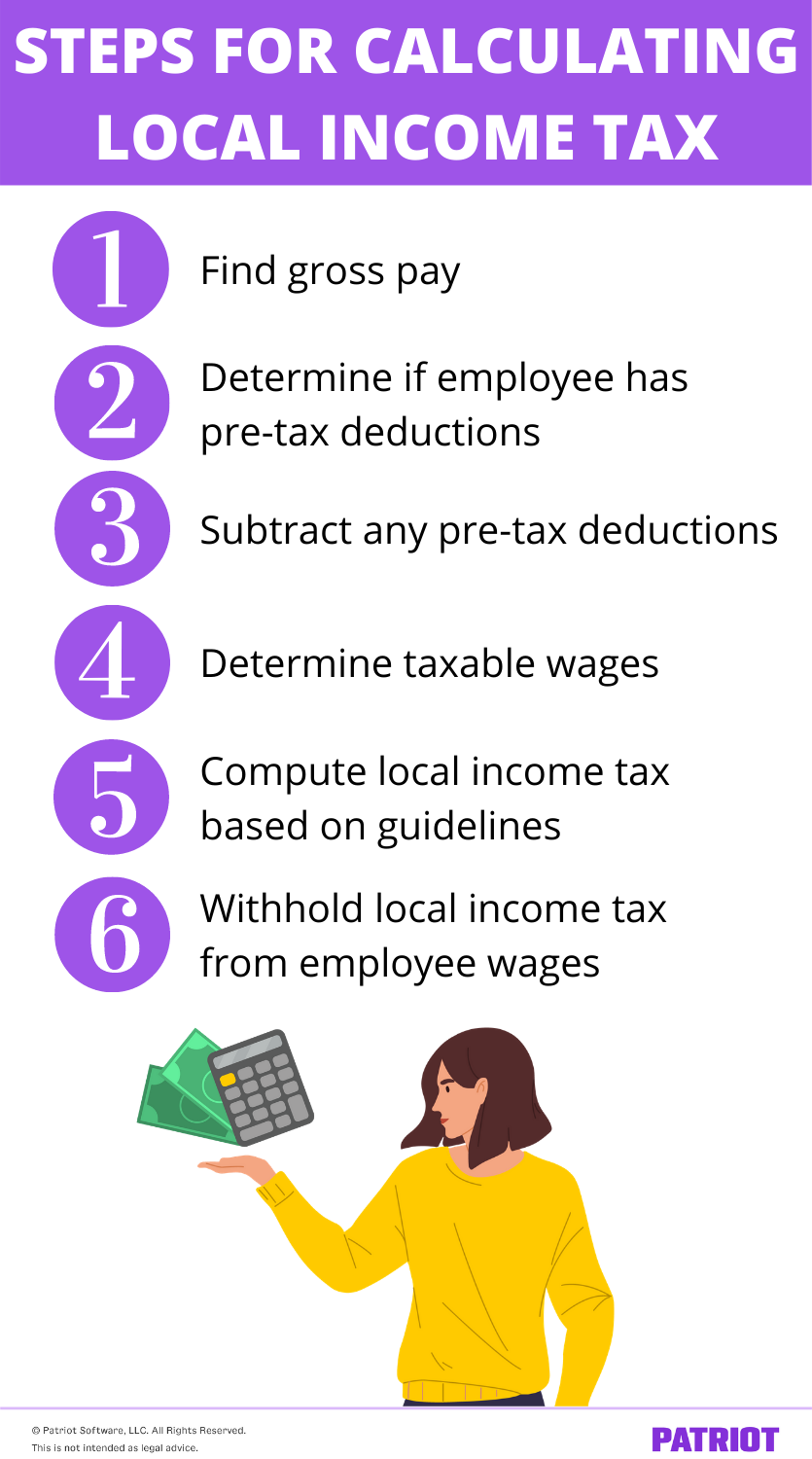

How To Calculate Local Income Tax Steps More

Illinois Paycheck Calculator Adp

The Cost Of Local Government In Philadelphia The Pew Charitable Trusts

How Are Payroll Taxes Calculated State Income Taxes Workest

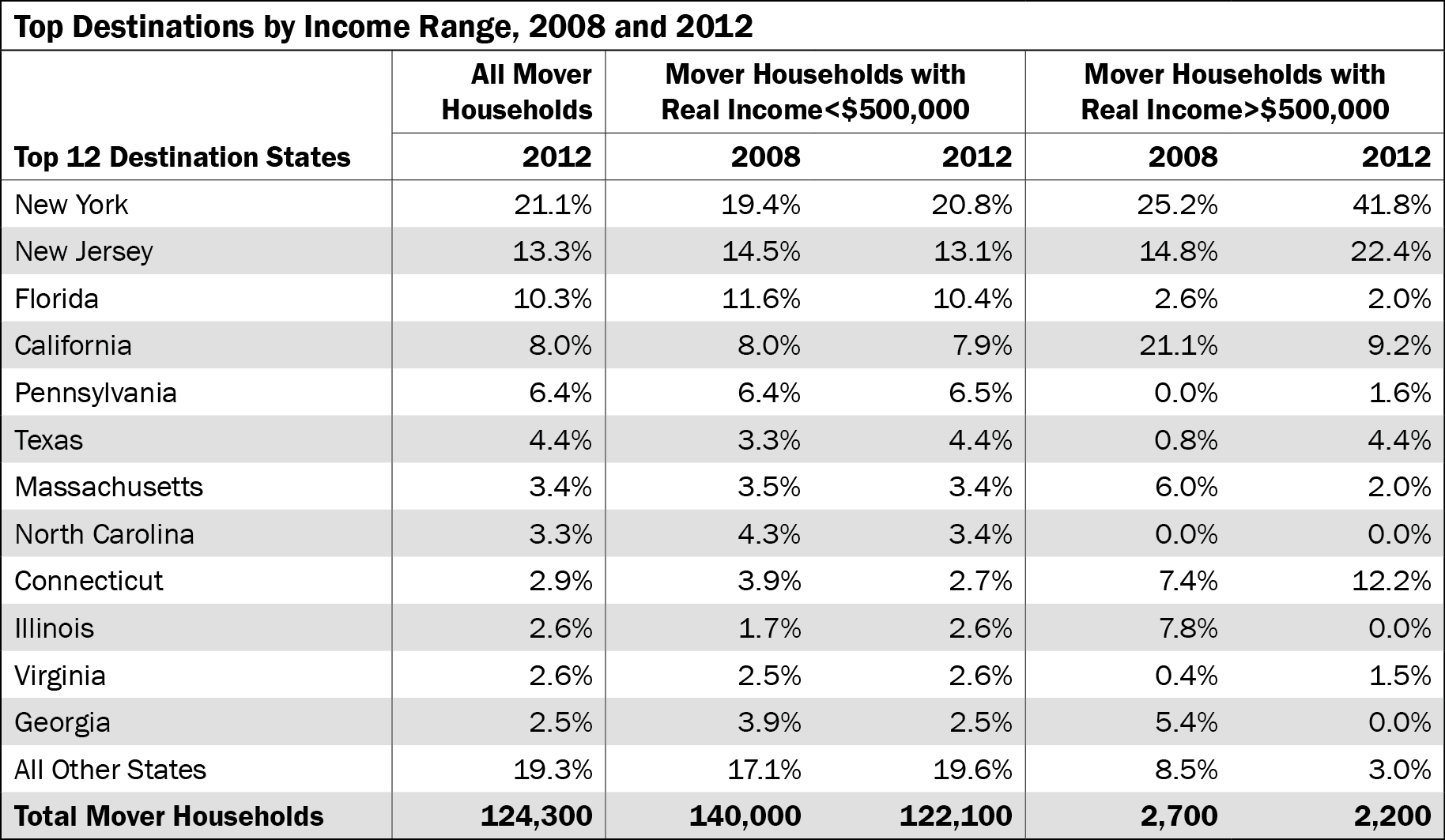

If Choosing Suburbs Surge In Nyc High Wage Earners Choosing Ny Nj Ct

2022 Sales Tax Rates State Local Sales Tax By State Tax Foundation

How To Calculate 2020 Federal Income Withhold Manually With 2019 And Earlier W4 Form

Federal Income Tax 61 Of Households Paid No Taxes For 2020 Money

How To Calculate 2020 Federal Income Withhold Manually With 2019 And Earlier W4 Form

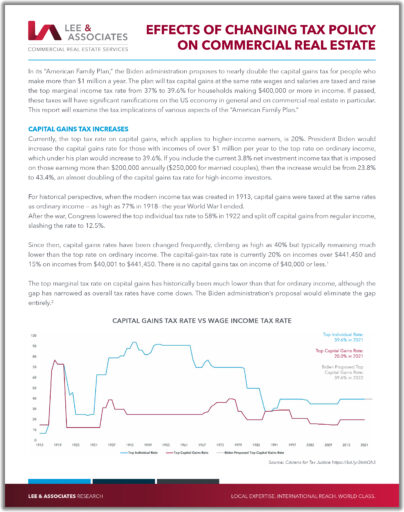

Effects Of Changing Tax Policy On Commercial Real Estate

5 Tricks For Getting A Bigger Paycheck In 2021 Money

Free Paycheck Calculator Hourly Salary Usa Dremployee

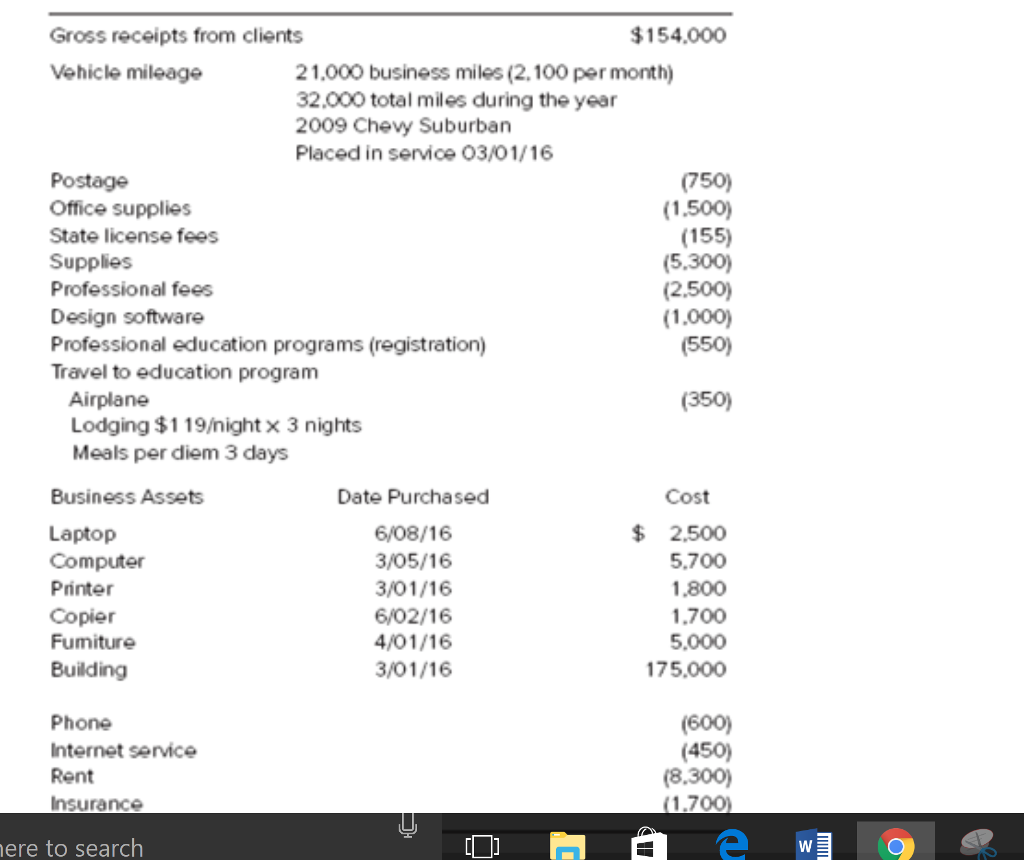

With Emphasis On Schedule C Shelly Beaman Social Chegg Com

State Of Working Nc 2021 Protecting Connecting Workers North Carolina Justice Center