who pays sales tax when selling a car privately in texas

For additional information about how to amend your report see. Web Who pays sales tax when selling a car privately in Texas.

If I Gift My Car To My Daughter Does She Have To Pay Taxes In Texas Sapling

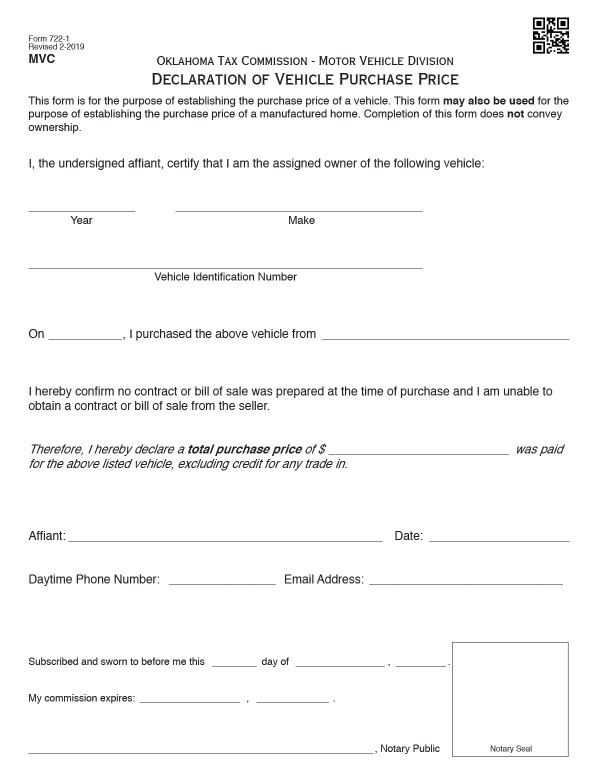

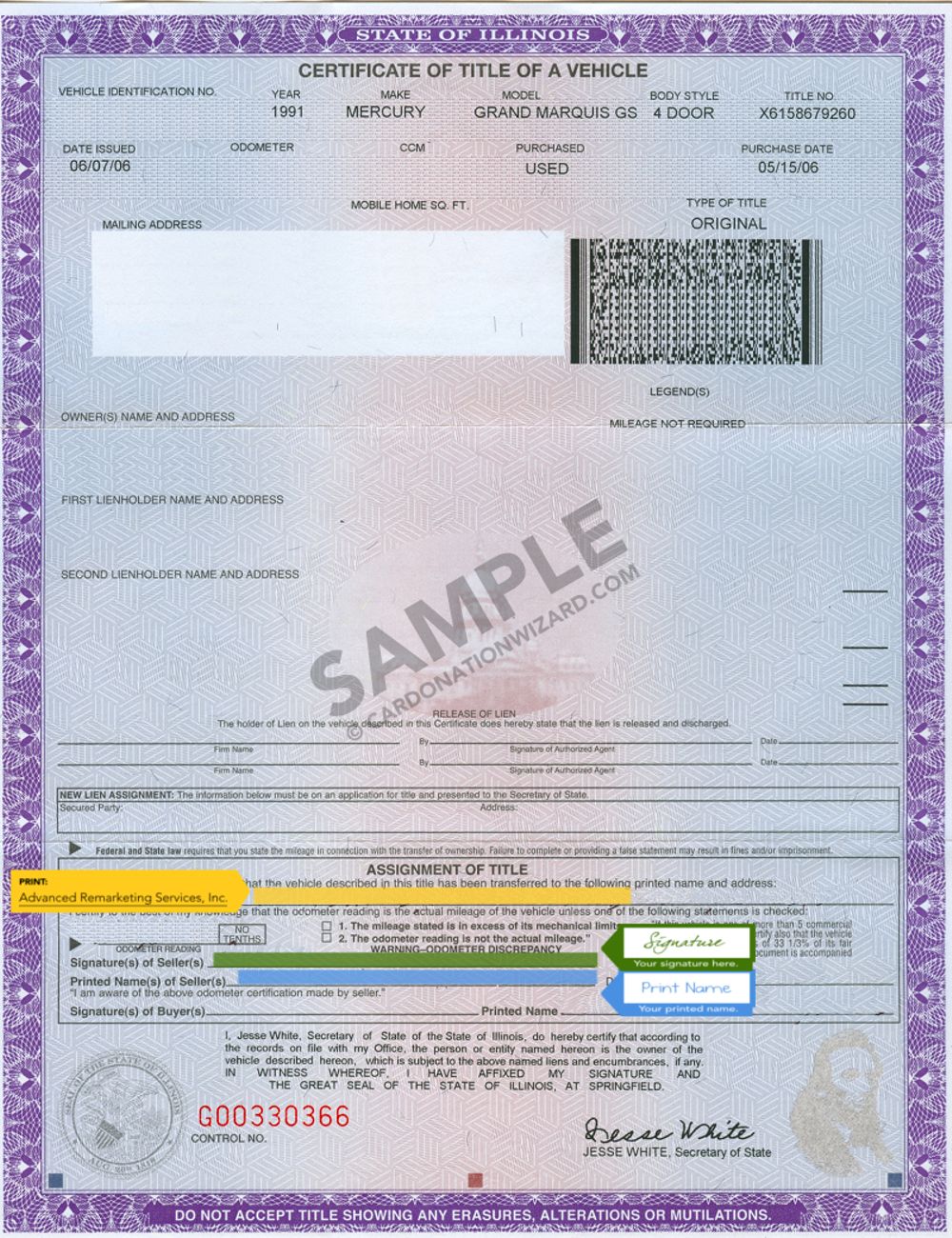

In many states you must complete a Bill of Sale but in Texas Form 130-U serves as the.

. Texans who buy a used vehicle from anyone other than a licensed vehicle dealer are required to pay motor vehicle sales tax of 625 percent. Web The sales tax for cars in Texas is 625 of the final sales price. The selling dealers signature on the title application is an acceptable record of the sales price.

Web Nov 3 2022 2 min read. Web If you buy a car in New Jersey then youll need to pay sales tax and other fees when you transfer ownership. If the seller is not a Texas licensed dealer the.

Web Who pays sales tax when selling a car privately in Texas. Motor vehicle sales tax is the purchasers responsibility. Web If as a resident of Texas you sell a car to someone in another state any sales tax is up to the buyer.

Web If you buy another car from the dealer at the same time many states offer a trade-in tax exemption that lowers the amount of sales tax youll pay in the trade. Web Austin Texas 78774-0100 If you overpaid your taxes see Sales Tax Refunds. If the buyer is living in another state then the tax would need.

If the seller is not a Texas licensed dealer the. For retail sales of new and used motor vehicles involving licensed motor vehicle dealers the motor. Texas residents 625 percent of sales price less.

Form 01-922 Instructions for. Web The taxable value of private-party purchases of used motor vehicles may be based on the standard presumptive value. Web If you spend 7000 on a car and an additional 1000 on improvements but you sell the car for 7000 its considered a capital loss and you dont need to pay tax on the.

Web If the seller does not transfer or keep their license plates the license plates must be disposed of by defacing the front of the plates either with permanent black ink or another. Web In Texas you must fill out a Certificate of Title application or Form 130-U. Web If you spend 7000 on a car and an additional 1000 on improvements but you sell the car for 7000 its considered a capital loss and you dont need to pay tax on.

Web While this question might seem a little complicated the answer is very straightforward and the simple answer is you dont have to pay taxes. Motor vehicle sales tax is the purchasers responsibility.

Do You Pay Sales Tax On A Mobile Home Purchase Mhvillager Blog

Texas Vehicle Sales Tax Fees Calculator Find The Best Car Price

Sales Taxes In The United States Wikipedia

What You Need When Selling Your Vehicle To A Private Party South Dakota Department Of Revenue

Illinois Imposing Car Trade In Tax On Jan 1 Dealers Call It Double Taxation

How To Close A Private Car Sale Edmunds

Do You Pay Sales Tax On A Lease Buyout Bankrate

8 Tips For Buying A Car Out Of State Carfax

Understanding California S Sales Tax

Car Tax By State Usa Manual Car Sales Tax Calculator

Private Party Vehicle Registration

How To Sell A Car Privately In Texas Topmarq

Ohio Sales Tax Small Business Guide Truic

Selling A Car In Texas Privateauto

Does The Seller Have To Pay Tax On A Vehicle When He Sells It

How To Sell A Car Privately In Texas Topmarq